I often quote Alan Miltz, ‘Turnover is vanity, profit is sanity, and cash is reality’ to explain the fundamental importance of cash to a business. A highly profitable company with double-digit, year-on-year growth can run out of cash if cash flow isn’t intentionally managed. High-growing companies risk running short of it without a purposeful focus on measuring and growing cash.

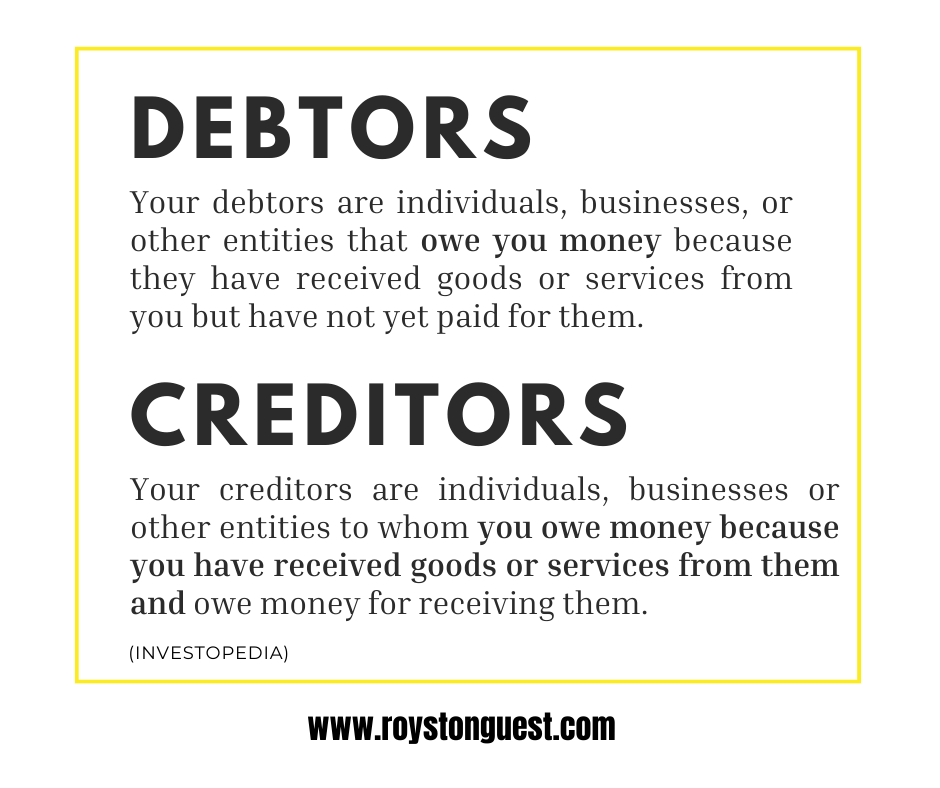

The money coming in and going out keeps operations running, and a key element is your debtors and creditors. Nearly every business is a creditor and a debtor because it extends credit to customers and pays suppliers on delayed payment terms. Understanding these two levers is crucial, as they directly impact cash flow and overall financial health.

To help you manage your cash flow and, in particular, your debtors and creditors, here are my top five practical tips.

Your business is not to provide a free credit facility for your customers; you are not a bank. Regularly reviewing your debtor and creditor payment cycles will ensure alignment with your cash flow schedule. If your debtor cycle (those who owe you money) is 60 days, but your creditor cycle (those who you owe money) is 30 days, you can see they’re out of sync. In this example, you must pay cash out before receiving cash, potentially causing a cash flow problem if you don’t have adequate cash reserves.

As a debtor, how you position your offering and the associated payment terms with your customers is crucial, as this will avoid any confusion or misunderstandings when you call in the debt. When I replaced my decking at home, the supplier asked me to pay for the materials before he installed anything; at the very least, he wasn’t funding the job on my behalf. I understood and accepted these terms as the customer.

Stage payments – payment schedules based on when work is completed on a project – are a sound financial strategy in business today, and most customers will understand that, as they are probably doing it themselves. There is nothing wrong with creating that expectation, nor any sense in being too polite about it. It is not that your cash collection should be reminiscent of a hungry shark, but it must be consistent and focused on ensuring that your cash management needs are taken care of.

As a creditor, it is all about your effectiveness in negotiating payment terms with suppliers. For example, negotiate discounts for early payment or extend payment deadlines to improve cash flow flexibility.

It is a pointless exercise if you review your payment cycles and terms but don’t fix potential problems or bottlenecks in your payment system. Are invoices processed promptly? Are there bottlenecks in the approval process? Are debts called for when due? Streamlining and automating, where possible, invoices, payment reminders, month-end or quarter-end statements, and overdue payments will help accelerate cash inflow and minimise delays.

Mastering cash flow is a non-negotiable as it is central to securing your business’s financial health and resilience. Regularly reconciling your debtor (accounts receivable) and creditor (accounts payment) positions identifies early any discrepancies between your records and those of your customers (debtors) or suppliers (creditors), potentially avoiding liquidity issues or preventing late fees or supply chain disruptions. It will give you a clear picture of your business’s financial health.

Business owners often get confused about how much money they have on hand at any one time because they’re holding it for someone else. For example, the revenue you collect on behalf of the government is in the form of corporation tax and VAT (or jurisdiction equivalent). Those amounts come into your account on payment of every invoice, but you must ring-fence them, perhaps by putting them into an entirely separate account, because they aren’t yours to spend.

I often see companies that receive a corporation tax or VAT bill—something predictable that occurs at regular intervals—scramble to find the cash to pay it because they mistakenly believe that 100% of the money in their accounts constitutes their free cash flow to fund their daily business activities. Corporation tax, VAT—or your equivalent—is not operating capital, and if you find yourself treating it as such, consider these practical tips to help you manage your cash flow more effectively.

Remember, cash is king!